views

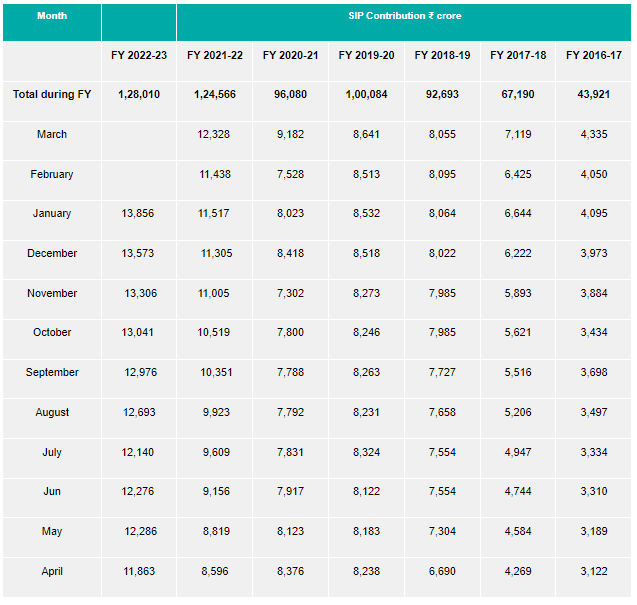

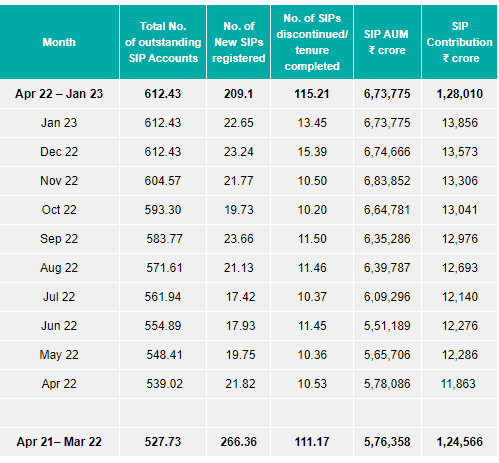

Indian Mutual Funds currently have about 6.22 crore (62.2 million) SIP accounts through which investors regularly invest in Mutual Fund schemes. Also, the total amount collected through SIP during January 2023 was Rs 13,856 crore, latest Association of Mutual Funds in India (AMFI) data show.

The Systematic Investment Plan or SIP assets under management (AUM) stood at Rs 6.73 crore for January 2023 and the month saw new SIP registrations at 22.65 crores.

Notably, a latest report by Anand Rathi said Indian mutual funds neutralised the impact of FII selloff in 2022. It noted that the money to MFs is coming mainly through SIP.

Moreover, SIP has been gaining popularity among Indian investors, as it helps in ‘Rupee Cost Averaging’ and also in investing in a disciplined manner without worrying about market volatility and timing the market.

Also Read: New To Mutual Funds? Know These Terms Before Investing

Rupee cost averaging ensures that you automatically buy more units when the NAV is low and fewer when the NAV is high.

Industry experts believe that the momentum of SIP inflow will continue to balance the FII outflows in the market.

Systematic Investment Plan or SIP as it is commonly known, is an investment plan (methodology) offered by Mutual Funds wherein one could invest a fixed amount in a mutual fund Scheme periodically at fixed intervals – say once a month instead of making a lump-sum investment.

With the rising awareness about mutual funds and equity markets for building a saving corpus for long term goals, SIPs have gained a popularity among many retail investors.

Also Read: SIP Or Lump sum? Factors You Should Consider Before Investing

SIP is one such method which has gained popularity among the investors, especially young first-time retail investors, who want to secure their retirement or have goals like owning a house or higher education.

SIP is seen as a convenient method of investing in mutual funds through standing instructions to debit your bank account every month, without the hassle of having to write out a cheque each time.

Investors must note that mutual funds are subject to market risk and they are advised to read all scheme related documents carefully before investing.

Read all the Latest Business News here

Comments

0 comment